401k employer contribution calculator

Money Not Math 62. Use this calculator to see how much more you could accumulate in your employer retirement plan over time by increasing the amount that you contribute from each paycheck.

401k Contribution Calculator Step By Step Guide With Examples

Second many employers provide matching contributions to your 401k account which can range from 0 to 100 of your contributions.

. An employee contribution of for An employer. A 401 k can be one of your best tools for creating a secure retirement. The combined result is a retirement savings plan you.

Specifically you are allowed to make. Solo 401k Contribution Calculator. Your Monthly 401k Contribution.

Ad Discover The Traditional IRA That May Be Right For You. Use this contribution calculator to help you determine how much you will have saved in your 401k fund when you retire. With a solo 401k you are allowed to make contributions in the role of employee and the role of employer.

Ad Help Secure Your Financial Future Through ABA Retirement Funds Retirement Plans. For every dollar you contribute to your qualified retirement plan your employer will also make a contribution to. Ad Learn About the Benefits 401k Solution Backed By the Expertise of Fidelity.

Ad Learn How Fidelity Can Help You Roll Over Your Old 401k Plan. Build Your Future With a Firm that has 85 Years of Retirement Experience. You only pay taxes on contributions and.

Learn About Contribution Limits. Calculator Definitions Annual salary The sum of your annual pay before any deductions such as tax. Many employers choose to match you 401k contributions up to certain limits.

That means your employer also contributes money to your 401k account as a job benefit. Definition of a 401k Account. Self-employed individuals and businesses employing only the owner partners and spouses have several options for tax-advantaged savings.

If for example your contribution percentage is so high that you obtain the 20500 year 2022 limit. Ad Help Secure Your Financial Future Through ABA Retirement Funds Retirement Plans. Ad TIAA IRAs Can Give You The Flexibility And Convenience You May Need.

There can be no match without an employee contribution and not all 401ks offer employer matching. Your 401k plan account might be your best tool for creating a secure retirement. Second many employers provide matching contributions to your account which can range from 0 to 100 of your contributions.

As an exampl See more. This federal 401k calculator helps you plan for the future. A Solo 401 k.

The employer match helps you accelerate your retirement contributions. Our Goal Is To Give You A More Logical Personal Way To Invest Manage Your Money. If the employee wants to withhold more than 4 percent of gross wages the benefit will match 50 percent up to 4 percent of the gross wages.

Ad Find Tips From AARP to Help You Understand How Much You Can Contribute to 401k Plans. The benefit will be calculated as. How to Calculate Roth 401k Withholding.

Use the Individual 401k Contribution Comparison to estimate the potential contribution that can be made to an Individual 401k compared to Profit Sharing SIMPLE or SEP plan. Many employees are not taking full advantage of their employers matching contributions. It provides you with two important advantages.

NerdWallets 401k retirement calculator estimates what your 401k balance will be at retirement by factoring in your contributions employer matching dollars your expected. First all contributions and earnings to your 401. Ad Understand The Impact Of Taking A Loan From Your Employer Sponsored Retirement Account.

Plan For the Retirement You Want With Tips and Tools From AARP. Use this calculator to see how increasing your contributions. Titans 401 k calculator gives anyone the ability to project potential returns from a 401 k retirement fund based on your current age 401 k balance and annual salary.

A 401k match is an employers percentage match of a participating employees contribution to their 401k plan usually up to a certain limit denoted as a percentage of the employees salary. Your Employers Monthly 401k Adding. Many employers and employees consider a good 401 match to be an employer contribution of 50 cents for.

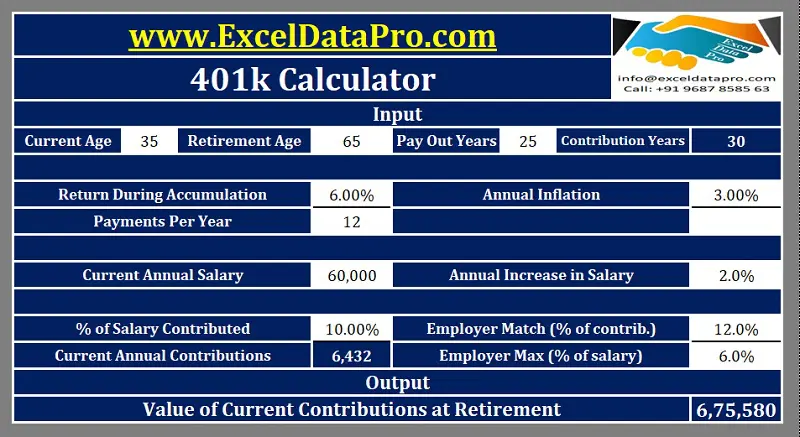

Download 401k Calculator Excel Template Exceldatapro

Excel 401 K Value Estimation Youtube

401 K Calculator See What You Ll Have Saved Dqydj

Simplified Formula Example 401k Match Youtube

401k Contribution Calculator Amazon Com Appstore For Android

401k Employee Contribution Calculator Soothsawyer

Download 401k Calculator Excel Template Exceldatapro

Doing The Math On Your 401 K Match Sep 29 2000

401k Contribution Calculator Step By Step Guide With Examples

Free 401k Calculator For Excel Calculate Your 401k Savings

Retirement Services 401 K Calculator

Customizable 401k Calculator And Retirement Analysis Template

401k Employee Contribution Calculator Soothsawyer

Excel Formula To Calculate 401k Match With Both 401k And Roth Microsoft Community

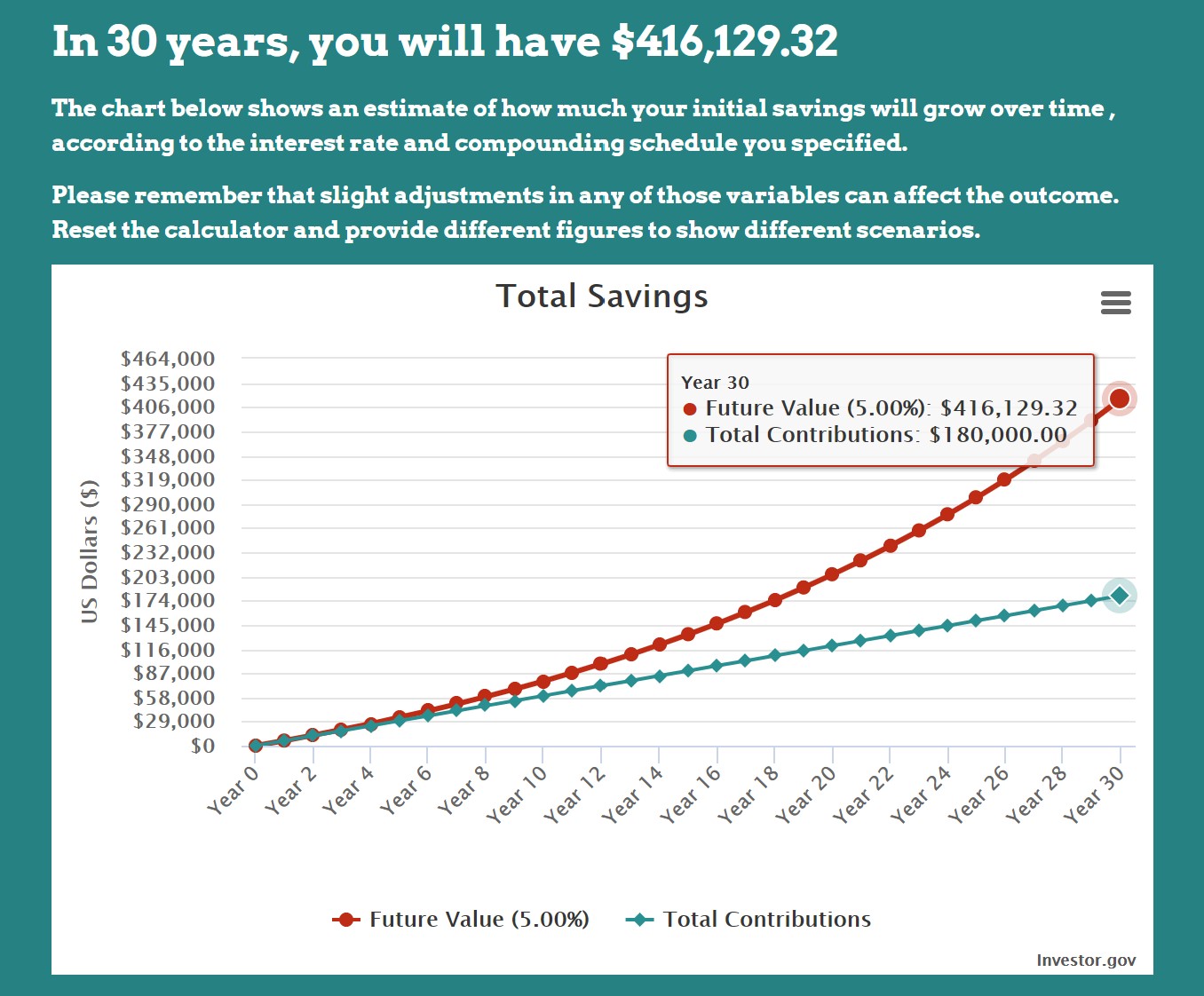

This 401k Match Calculator Shows How Powerful Compound Interest Can Be

What Is A 401 K Match Onplane Financial Advisors

How Much Can I Contribute To My Self Employed 401k Plan